Artificial Intelligence (AI) is used in many areas. Among others, AI solutions have gained popularity in the financial sector.

Why AI is important to the financial sector

Artificial intelligence opens up a lot of opportunities for the financial sector. At the same time, in addition to the obvious pros, AI also brings a number of disadvantages.

Pros

Сons

7 Use Cases of AI in Finance

1. Risk assessment and forecasting

AI can quickly process a large amount of information to assess the risk, such as a particular person's loan. To do this, the system analyzes credit history and other records that help determine prospects for a contract.

2. Detecting and combating fraud

According to IBM, global fraud losses will reach $44 billion by 2025. About 72% of CEOs consider this potential loss a serious problem. Aiding financial institutions in the fight against fraud has become artificial intelligence.

For example, artificial intelligence can compare user behaviour with patterns embedded in the program. The actions of fraudsters often go beyond normal transactions, which allows the AI to quickly capture suspicious activity and alert the lending institution.

Why AI is important to the financial sector

Artificial intelligence opens up a lot of opportunities for the financial sector. At the same time, in addition to the obvious pros, AI also brings a number of disadvantages.

Pros

- Automation of routine work

- Reduced costs due to the automation of part of the work, as well as the rapid detection of fraud and possible errors

- Improving the quality of customer service through personalization of services and expanding the list of available services

- Improving the quality of work by reducing possible human errors

- Increased business security

Сons

- The closed nature of AI systems. Many companies don't report on what data AI-based automated systems help them collect. For example, in early 2019, Google admitted that it inadvertently collected personal information from users' accounts

- Errors in AI code are not ruled out

- Artificial intelligence cannot replace humans in many matters

- Contributes to the reduction of labour

- AI systems imply centralized management

7 Use Cases of AI in Finance

1. Risk assessment and forecasting

AI can quickly process a large amount of information to assess the risk, such as a particular person's loan. To do this, the system analyzes credit history and other records that help determine prospects for a contract.

2. Detecting and combating fraud

According to IBM, global fraud losses will reach $44 billion by 2025. About 72% of CEOs consider this potential loss a serious problem. Aiding financial institutions in the fight against fraud has become artificial intelligence.

For example, artificial intelligence can compare user behaviour with patterns embedded in the program. The actions of fraudsters often go beyond normal transactions, which allows the AI to quickly capture suspicious activity and alert the lending institution.

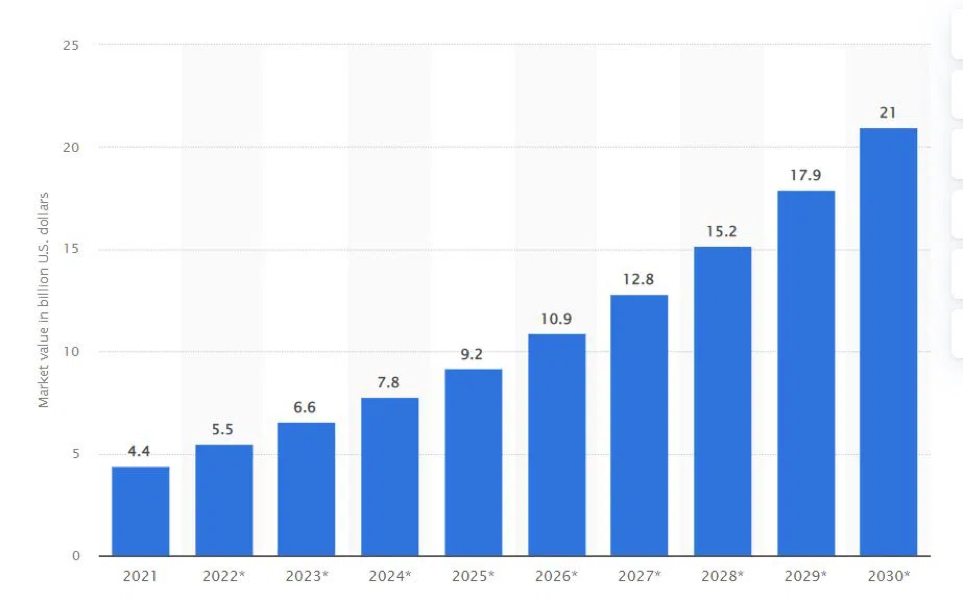

Artificial Intelligence Market Growth Forecast. Source: Statista

3. Financial advice

Automated advisors based on AI can promptly give recommendations to users, based on the results of processing information about the state of the market, or evaluate the effectiveness of portfolio assets of a financial institution's client. For example, such systems can provide investment advice based on historical trends.

4. AI in trading

Sometimes behaviour of the financial market can confuse even the most experienced traders. AI is able to analyze its movements in the past, analyze the news background, identify important patterns and compare them to current realities to make predictions and make profitable deals. At the same time, artificial intelligence can learn from its mistakes.

According to JPMorgan, as early as 2020, more than 60% of trades over $10 million were conducted with the help of algorithms. According to experts, the figure will reach $19 million by 2024.

5. Personalization of financial services

A personalized approach is one of the factors of quality service. Manual customization of offers for each client takes a lot of time. Therefore, many companies use AI for this purpose.

Artificial intelligence can analyze customer behaviour patterns and identify customer preferences based on available records. The results will help the program personalize financial services for a particular user.

6. Automation of operations

AI takes over a significant part of the routine work that takes up a lot of time and effort. For example, AI can do mailings on its own, calculate the amount of clients' investment assets, and even handle some of the user requests of credit institutions.

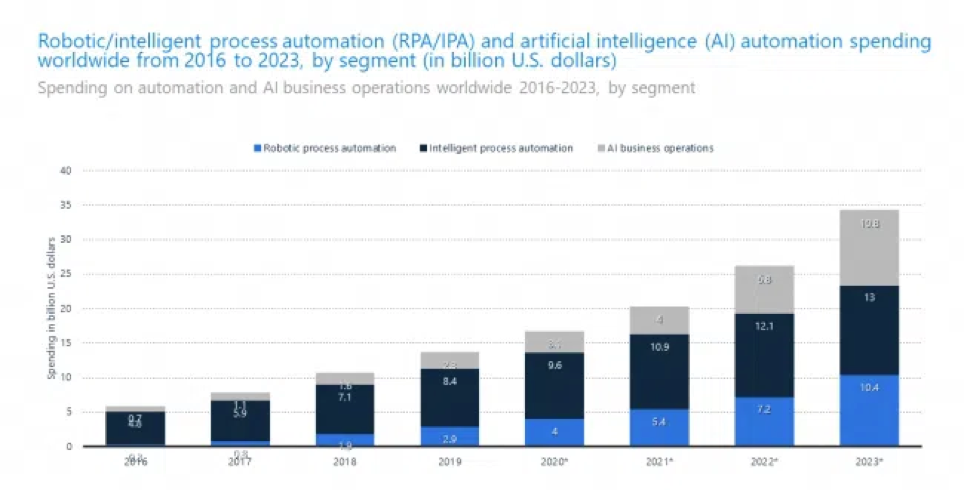

Statistics on spending on automation and moving businesses to AI solutions. Source: Statista

7. Regulation and enforcement

AI scripts help banks comply with rules and internal policies when interacting with customers. At points where a real advisor might stumble and, for example, succumb to emotion, the artificial intelligence will continue to do its job according to strictly regulated rules. Also, the AI can quickly collate data, for example, to identify the legitimacy of a particular transaction.