Bitcoin dominance (BTCD) is defined as the ratio of Bitcoin's market capitalisation to that of the other cryptocurrency markets.

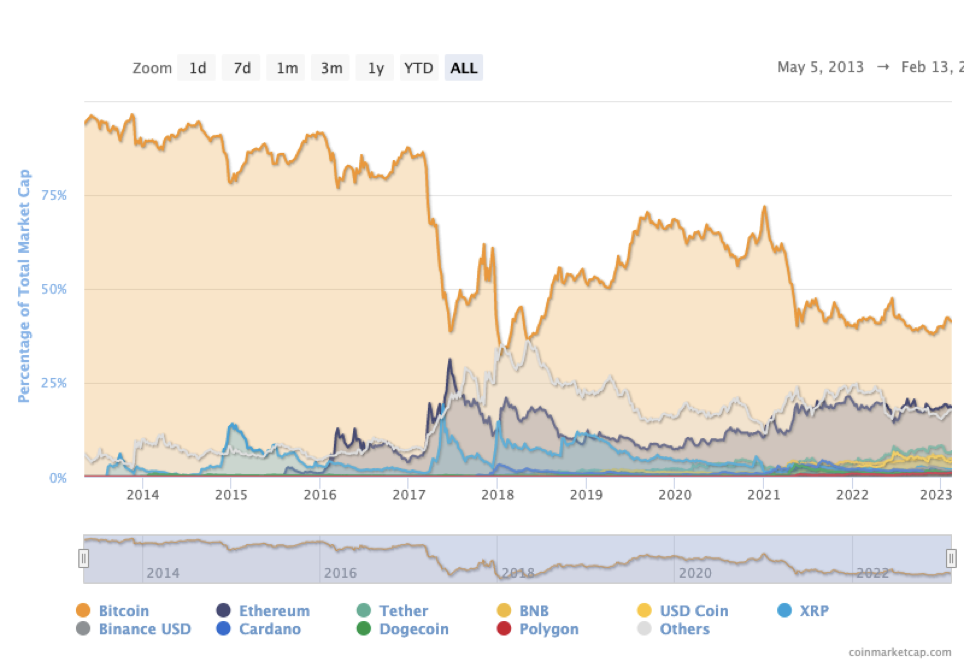

In terms of market capitalisation, Bitcoin is the most expensive cryptocurrency in the world and accounts for a significant percentage of trading activity on cryptocurrency exchanges. And while it has certainly been the most popular cryptocurrency for years (and still is), Bitcoin's market share was much closer to 100% five years ago than it is now. As new currencies and technologies like Ethereum emerged, Bitcoin's overall dominance began to wane. That all changed in 2017 when the altcoin boom began. By February 2017, BTC's market dominance had shrunk to 85.4%, ETH held 5.7% of the cryptocurrency market, and Ripple XRP grabbed a 1.1% share.

From that point, it was only a matter of time before Bitcoin's market share fell, as a flurry of ICOs significantly boosted the industry's market capitalisation. As of this writing, BTCD is 43.83% and continues to decline as new coins and tokens continue to enter the cryptocurrency markets.

No other cryptocurrency, however, has ever come close to the popularity of Bitcoin. That's why when the price of Bitcoin falls sharply, other altcoins in the market also fall, and vice versa.

Let's look at BTC's changing dominance against four other coins that are also among the top 5 most capitalised cryptocurrencies: Ethereum (ETH), Tether Stablecoin (USDT), Binance Coin (BNB) and USD Coin Stablecoin (USDC). Here are the points to watch out for:

In terms of market capitalisation, Bitcoin is the most expensive cryptocurrency in the world and accounts for a significant percentage of trading activity on cryptocurrency exchanges. And while it has certainly been the most popular cryptocurrency for years (and still is), Bitcoin's market share was much closer to 100% five years ago than it is now. As new currencies and technologies like Ethereum emerged, Bitcoin's overall dominance began to wane. That all changed in 2017 when the altcoin boom began. By February 2017, BTC's market dominance had shrunk to 85.4%, ETH held 5.7% of the cryptocurrency market, and Ripple XRP grabbed a 1.1% share.

From that point, it was only a matter of time before Bitcoin's market share fell, as a flurry of ICOs significantly boosted the industry's market capitalisation. As of this writing, BTCD is 43.83% and continues to decline as new coins and tokens continue to enter the cryptocurrency markets.

No other cryptocurrency, however, has ever come close to the popularity of Bitcoin. That's why when the price of Bitcoin falls sharply, other altcoins in the market also fall, and vice versa.

Let's look at BTC's changing dominance against four other coins that are also among the top 5 most capitalised cryptocurrencies: Ethereum (ETH), Tether Stablecoin (USDT), Binance Coin (BNB) and USD Coin Stablecoin (USDC). Here are the points to watch out for:

- Bitcoin’s level of market dominance has been declining throughout its existence.

- The first significant drop in BTC dominance was recorded between March and June 2017. During the same period, the dominance of the second most capitalised cryptocurrency, Ethereum, increased significantly. At this time came the ICO boom. Many projects were launched on the Ethereum network. Hence the growth of the dominance of ETH. After Ethereum's dominance began to decline, BTC's level of dominance began to recover.

- In the fall of 2019, bitcoin's dominance trend began to decline, which continues to this day. In parallel, the level of Ethereum dominance - on the contrary, is growing.

- Against the background of the beginning of the downward trend in bitcoin dominance in the fall of 2019, the dominance of other participants in the top 5 most capitalised cryptocurrencies began to grow.

Interesting. Bitcoin's dominance low of 32.44% was recorded on January 14, 2018.

Here are a couple of conclusions:

Bitcoin behavior amid changes in dominance levels

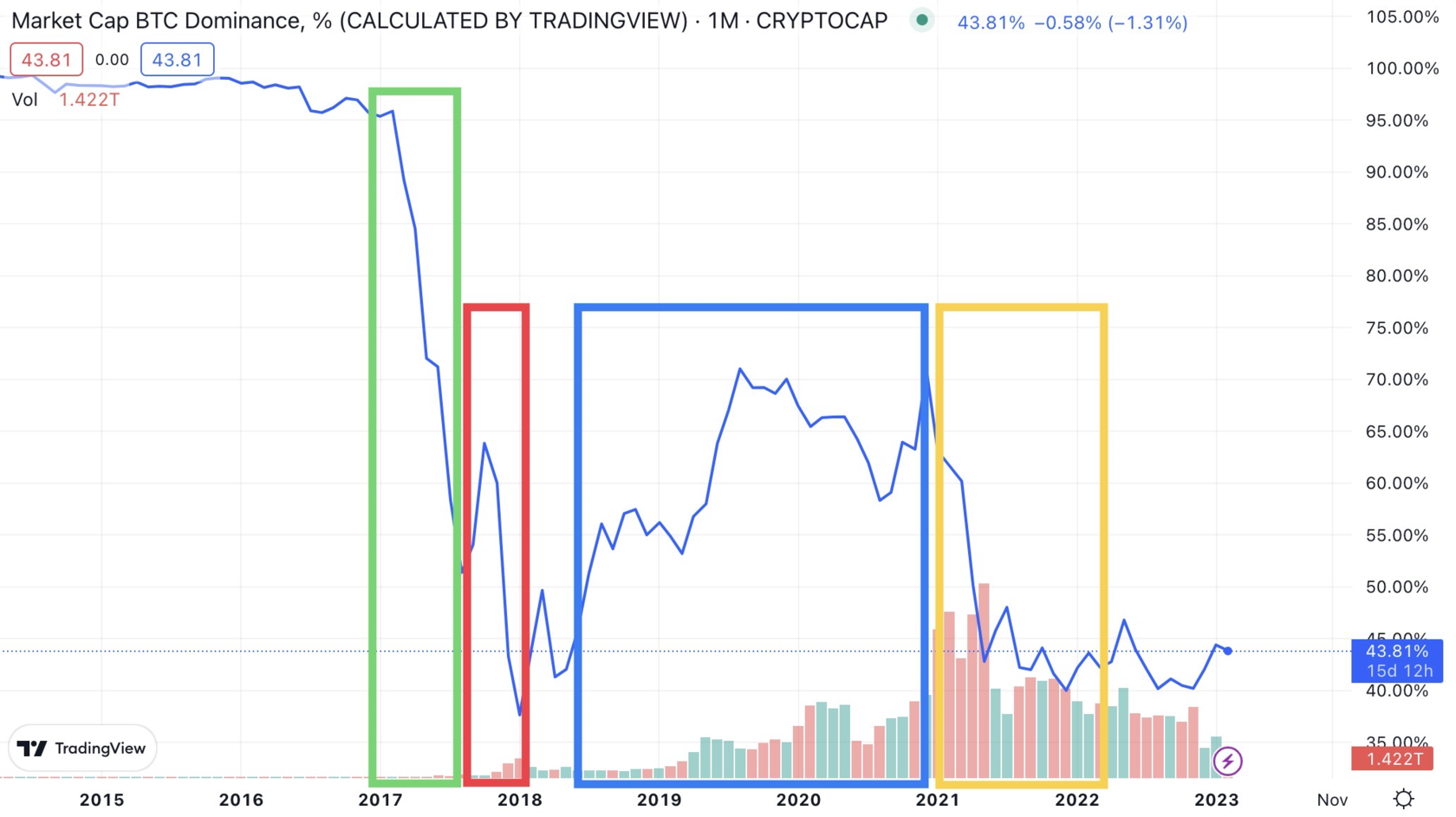

To understand how bitcoin's dominance level and rate behavior are related, let's look at both metrics in tandem. Here are the points to pay attention to:

- Green rectangle Bitcoin's first-ever period of active dominance decline. The metric was declining despite the growth of BTC. Ethereum dominance was actively growing during the same period.

- Red Rectangle The period when bitcoin reached a cyclical high near the $20k level in December 2017. On the contrary, the dominance of its main competitor, ETH, began to decline amid the growth of BTC.

- Blue RectangleCrypto Winter after updating a cyclical high near $20k in late 2017. Against the backdrop of a prolonged price decline in the digital asset market, many altcoins have not withstood the strain. As a result, a significant portion of capitalisation flowed back into bitcoin, supporting its rising dominance.

- Yellow Rectangle A period of active growth and renewal of the cyclical high near $69 thousand in November 2021. This time, bitcoin's dominance level continued to decline. At the same time, in the moment, against the background of the renewal of the absolute maximum, a flash of growth of BTC dominance was fixed.

- Capitalisation leaders compete for market share all the time. The successes of one project often entail a decrease in the dominance of other coins, at the expense of taking over their market share.

- The trend suggests that other capitalisation leaders cryptocurrencies will continue to take market share away from bitcoin.

- Bitcoin's decline in dominance coincides with periods of growth in the altcoin market.

- As the market plunges into crypto winter 2022, the rate of redistribution of dominance has declined.

Bitcoin behavior amid changes in dominance levels

To understand how bitcoin's dominance level and rate behavior are related, let's look at both metrics in tandem. Here are the points to pay attention to:

- Green rectangle Bitcoin's first-ever period of active dominance decline. The metric was declining despite the growth of BTC. Ethereum dominance was actively growing during the same period.

- Red Rectangle The period when bitcoin reached a cyclical high near the $20k level in December 2017. On the contrary, the dominance of its main competitor, ETH, began to decline amid the growth of BTC.

- Blue RectangleCrypto Winter after updating a cyclical high near $20k in late 2017. Against the backdrop of a prolonged price decline in the digital asset market, many altcoins have not withstood the strain. As a result, a significant portion of capitalisation flowed back into bitcoin, supporting its rising dominance.

- Yellow Rectangle A period of active growth and renewal of the cyclical high near $69 thousand in November 2021. This time, bitcoin's dominance level continued to decline. At the same time, in the moment, against the background of the renewal of the absolute maximum, a flash of growth of BTC dominance was fixed.

Overall conclusions

The multi-year trend indicates that bitcoin's level of market dominance will gradually decline. Cryptocurrencies are slower to "pull the blanket" during periods of crypto winter. The most rapid redistribution of dominance in the market of digital assets is in moments of active movements of the BTC exchange rate.

Bitcoin's decline in dominance often coincides with altcoin's rise and the overall market's transition into a positive phase. Therefore, changes in the metric may be a harbinger of a shift in sentiment in the crypto industry.

Despite the likelihood of a further decline in bitcoin's dominance, we can assume that the coin will retain its status as a capitalization leader.

The multi-year trend indicates that bitcoin's level of market dominance will gradually decline. Cryptocurrencies are slower to "pull the blanket" during periods of crypto winter. The most rapid redistribution of dominance in the market of digital assets is in moments of active movements of the BTC exchange rate.

Bitcoin's decline in dominance often coincides with altcoin's rise and the overall market's transition into a positive phase. Therefore, changes in the metric may be a harbinger of a shift in sentiment in the crypto industry.

Despite the likelihood of a further decline in bitcoin's dominance, we can assume that the coin will retain its status as a capitalization leader.

* All types of content you may see on Connectee Blog are not financial, investment, trading or any other advice. We do not provide advice on buying or selling assets.