What is Proof-of-Reserve?

Proof-of-Reserve is a scheme that provides evidence of asset reserves to ensure customer balance integrity. It aims to restore trust between parties by increasing transparency in a company's operations. Centralized platforms, which do not regularly disclose open data about the security of assets, utilize this measure.

The Trust Issue

The main issue with centralization, in the context of cryptocurrencies, is the necessity to trust a third party. For example, when you send your Bitcoins to a Binance wallet, the centralized model entails transferring the coins to the custody of the exchange. Consequently, users must trust the trading platform and rely on its representatives' assurances regarding the security of their assets.

On the other hand, decentralized operations automate coin storage through smart contracts and data recording on the blockchain. In this case, there is no need to trust a third party, as the system operates automatically and provides evidence of asset security through blockchain data verification.

How FTX Pushed for Proof-of-Reserve

In November 2022, the digital asset market experienced a shock with the collapse of FTX, one of the largest centralized cryptocurrency exchanges founded by businessman Sam Bankman-Fried. The platform faced an $8 billion budget hole.

The collapse of one of the largest centralized exchanges once again shook the trust of the cryptocurrency community in such platforms. Other exchanges also came under scrutiny. To dispel doubts, centralized platforms began seeking solutions to provide users with evidence of asset security. Proof-of-Reserve based on Merkle Trees emerged as a solution for many.

How Proof-of-Reserve Works with Merkle Trees

Merely publishing reports is insufficient to restore trust between clients and centralized platforms. Users want proof that the information in the documents aligns with reality. This is where Merkle Trees, or hash trees, come into play. They are a decentralized data management concept that enables the provision of verifiable evidence by organizing and hashing data, with subsequent storage on the blockchain.

Hash trees address the trust issue faced by centralized platforms. The concept allows platforms to provide customers with evidence of asset security based on a decentralized system that does not require trust.One of the pioneers in advocating for Proof-of-Reserve using Merkle Trees was Changpeng Zhao, the founder of Binance. It was Binance's pressure that triggered the collapse of Sam Bankman-Fried's empire at FTX.

Practical Applications of PoR

Following the FTX collapse, many cryptocurrency exchanges began publishing Proof-of-Reserve to regain customer trust. Some of the platforms that provided PoR based on Merkle Trees include:

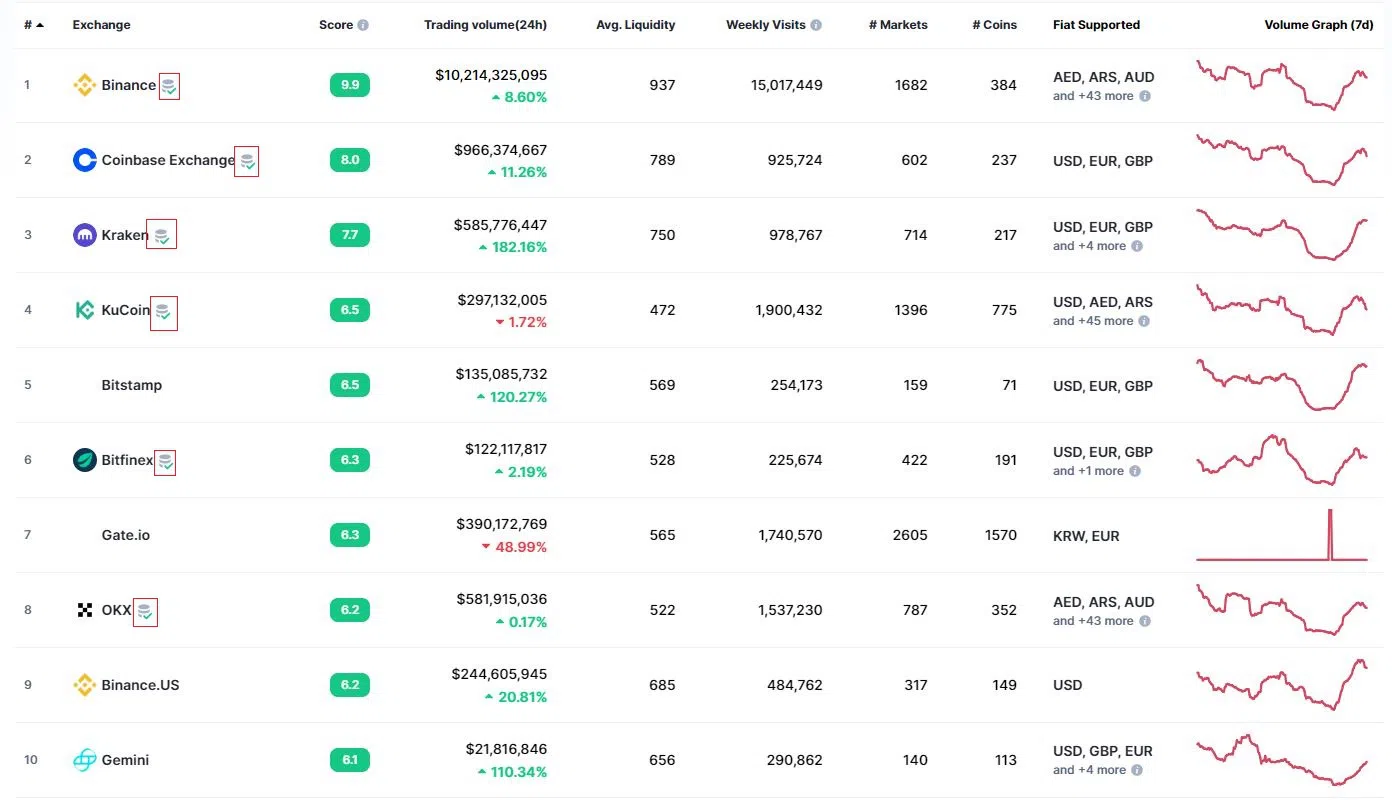

In late November 2022, CoinMarketCap, a popular cryptocurrency data aggregator, launched a tracker for exchanges that provided Proof-of-Reserve. This tracker allows users to see which platforms have published evidence of their reserves. Such exchanges are marked with a special icon

Proof-of-Reserve is a scheme that provides evidence of asset reserves to ensure customer balance integrity. It aims to restore trust between parties by increasing transparency in a company's operations. Centralized platforms, which do not regularly disclose open data about the security of assets, utilize this measure.

The Trust Issue

The main issue with centralization, in the context of cryptocurrencies, is the necessity to trust a third party. For example, when you send your Bitcoins to a Binance wallet, the centralized model entails transferring the coins to the custody of the exchange. Consequently, users must trust the trading platform and rely on its representatives' assurances regarding the security of their assets.

On the other hand, decentralized operations automate coin storage through smart contracts and data recording on the blockchain. In this case, there is no need to trust a third party, as the system operates automatically and provides evidence of asset security through blockchain data verification.

How FTX Pushed for Proof-of-Reserve

In November 2022, the digital asset market experienced a shock with the collapse of FTX, one of the largest centralized cryptocurrency exchanges founded by businessman Sam Bankman-Fried. The platform faced an $8 billion budget hole.

The collapse of one of the largest centralized exchanges once again shook the trust of the cryptocurrency community in such platforms. Other exchanges also came under scrutiny. To dispel doubts, centralized platforms began seeking solutions to provide users with evidence of asset security. Proof-of-Reserve based on Merkle Trees emerged as a solution for many.

How Proof-of-Reserve Works with Merkle Trees

Merely publishing reports is insufficient to restore trust between clients and centralized platforms. Users want proof that the information in the documents aligns with reality. This is where Merkle Trees, or hash trees, come into play. They are a decentralized data management concept that enables the provision of verifiable evidence by organizing and hashing data, with subsequent storage on the blockchain.

Hash trees address the trust issue faced by centralized platforms. The concept allows platforms to provide customers with evidence of asset security based on a decentralized system that does not require trust.One of the pioneers in advocating for Proof-of-Reserve using Merkle Trees was Changpeng Zhao, the founder of Binance. It was Binance's pressure that triggered the collapse of Sam Bankman-Fried's empire at FTX.

Practical Applications of PoR

Following the FTX collapse, many cryptocurrency exchanges began publishing Proof-of-Reserve to regain customer trust. Some of the platforms that provided PoR based on Merkle Trees include:

- Bitget

- BingX

- Binance

In late November 2022, CoinMarketCap, a popular cryptocurrency data aggregator, launched a tracker for exchanges that provided Proof-of-Reserve. This tracker allows users to see which platforms have published evidence of their reserves. Such exchanges are marked with a special icon

Conclusion

Not all members of the cryptocurrency community believe that publishing Proof-of-Reserve based on Merkle Trees will enhance the security of centralized platforms. For example, Jesse Powell, the CEO and co-founder of the American exchange Kraken, called this practice meaningless. He explained that interested parties could manipulate the data to ensure that the "tree" aligns with the company's interests. Jesse Powell believes that PoR can only be trusted when the proof of assets is verified by an independent auditor.

Centralized platforms have taken heed of the criticism. Many exchanges promptly had their Proof-of-Reserve audited by third-party firms. For instance, BingX cryptocurrency exchange underwent such audits. Similarly, Binance, Crypto.com, and several other platforms underwent verification by auditors.